Are Va Disability Payments Taxable

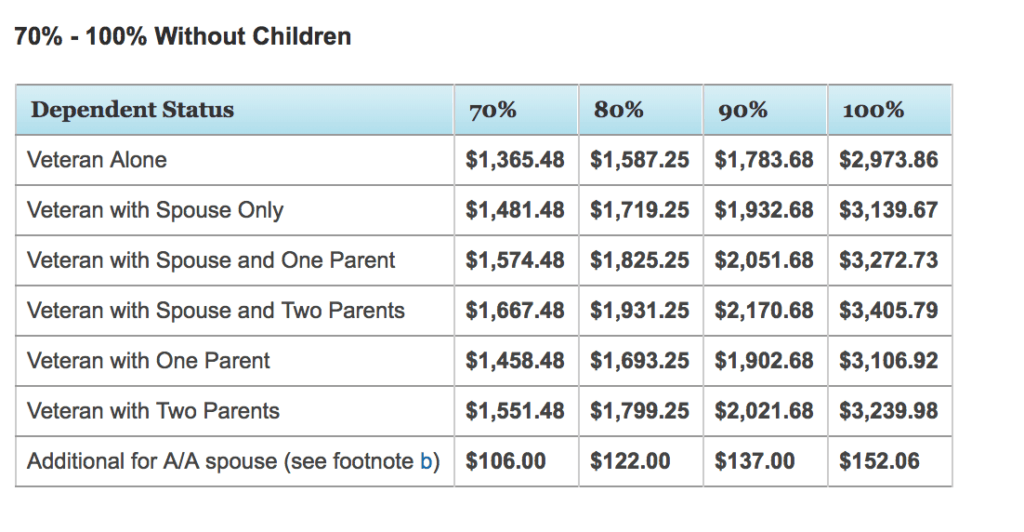

payments taxable wallpaperDistributions are tax free if used to pay the beneficiarys qualified disability expenses. Use our compensation benefits rate tables to find your monthly payment amount.

Can You Receive Va Disability And Military Retirement Pay Cck Law

Compensation rates for Veterans with a 10 to 20 disability rating.

Are va disability payments taxable. However military disability retirement pay and Veterans benefits including service-connected disability pension payments may be partially or fully excluded from taxable income. We base your monthly payment amount on your disability rating and details about your dependent family members. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes.

Other Nontaxable Disability Payments. Tax-free disability benefits include. Many other states have state income tax but VA and Social Security disability payments are tax-free in all states.

On a federal level VA disability payments arent taxable at all. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable.

Certain amounts received by wrongfully incarcerated individuals. Do not include them as income on your tax return. 907 for more information.

Other disability-related payments that are not taxable include. However Military Disability Retirement pay could be taxable if reported on form 1099-R. You dont need to include them as income on your tax return.

Under this federal law Veterans who suffer combat-related injuries and are separated from the military are not to be taxed on the one-time lump sum disability severance payment they receive from the Department of Defense. Combat-Injured Veterans Tax Fairness Act of 2016 The Combat-Injured Veterans Tax Fairness Act of 2016 went into effect in 2017. Disability compensation and pension payments for disabilities paid either to veterans or their families.

Veterans disability benefits are not taxable. However military disability retirement pay and. Payments made under the VAs compensated work therapy program.

Learn more about VA benefits here. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable and dont need to be reported on your return. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service.

Certain amounts you receive due to a wrongful incarceration may be excluded from gross income. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Benefit payments from a public welfare fund such as payments due to blindness.

You can exclude the disability payments from your taxable income if any of the following conditions apply. If you receive disability retirement pay as a pension annuity or similar allowance for personal injury or sickness you may be able to exclude these payments from your income. Generally Social Security Disability Benefits SSDI arent taxable unless you have substantial additional income more than 25000 for an individual or 32000 for married filers.