Are Va Disability Payments Taxable

payments taxable wallpaperDistributions are tax free if used to pay the beneficiarys qualified disability expenses. Use our compensation benefits rate tables to find your monthly payment amount.

Can You Receive Va Disability And Military Retirement Pay Cck Law

Compensation rates for Veterans with a 10 to 20 disability rating.

Are va disability payments taxable. However military disability retirement pay and Veterans benefits including service-connected disability pension payments may be partially or fully excluded from taxable income. We base your monthly payment amount on your disability rating and details about your dependent family members. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes.

Other Nontaxable Disability Payments. Tax-free disability benefits include. Many other states have state income tax but VA and Social Security disability payments are tax-free in all states.

On a federal level VA disability payments arent taxable at all. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable.

Certain amounts received by wrongfully incarcerated individuals. Do not include them as income on your tax return. 907 for more information.

Other disability-related payments that are not taxable include. However Military Disability Retirement pay could be taxable if reported on form 1099-R. You dont need to include them as income on your tax return.

Under this federal law Veterans who suffer combat-related injuries and are separated from the military are not to be taxed on the one-time lump sum disability severance payment they receive from the Department of Defense. Combat-Injured Veterans Tax Fairness Act of 2016 The Combat-Injured Veterans Tax Fairness Act of 2016 went into effect in 2017. Disability compensation and pension payments for disabilities paid either to veterans or their families.

Veterans disability benefits are not taxable. However military disability retirement pay and. Payments made under the VAs compensated work therapy program.

Learn more about VA benefits here. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable and dont need to be reported on your return. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service.

Certain amounts you receive due to a wrongful incarceration may be excluded from gross income. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Benefit payments from a public welfare fund such as payments due to blindness.

You can exclude the disability payments from your taxable income if any of the following conditions apply. If you receive disability retirement pay as a pension annuity or similar allowance for personal injury or sickness you may be able to exclude these payments from your income. Generally Social Security Disability Benefits SSDI arent taxable unless you have substantial additional income more than 25000 for an individual or 32000 for married filers.

How To Check Va Disability Payments

payments wallpaperIf your decision notice shows at least a 10 disability rating youll get your first payment within 15 days. However veterans may also apply by mail with VA Form 21-526EZ in person at your regional benefits office or with help from a trained professional.

6 C P Exam Success Tips For Disabled Veterans Exam Success Disability Disabled Veterans Benefits

Vital records such as marriage and dependent birth certificates.

How to check va disability payments. Call us at 918-781-7550 for international direct deposit updates or. The Department of Veterans Affairs recommends eligible veterans apply for disability compensation benefits through the VAs eBenefits online portal. VA disability benefits typically cannot be garnished for these types of payments.

Benefits Explorer View a personalized list of possible benefits based on your VADoD eBenefits profile. If you recently received a grant resulting in VA disability back pay you may want to use the calculator to get an idea of how much money you will receive. Compensation rates for Veterans with a 10 to 20 disability rating.

You can view your disability ratings online if you got a decision notice from us in the mail confirming your disability rating. 1 DFAS check for service retired pay with the full VA waiver amount subtracted. Military disability benefits may be garnished if a veteran is receiving disability compensation in lieu of retirement pay.

And 3 branch of service check for CRSC reimbursement. You can check the status of pending claims with the claim status tool. Use our compensation benefits rate tables to find your monthly payment amount.

Thus veterans receiving CRSC will get three separate checks each month. You can also see certain survivor benefits. Go to your My VA dashboard.

View your VA disability payments history. However there are exceptions to the rule. Service members within 1 180 days from discharge should go to httpswwwvagovdisabilityhow-to-file-claim to submit your Pre-Discharge VA disability claim.

There youll see a summary of the latest status information for any open claims or appeals you may have. Benefits Explorer View a personalized list of possible benefits based on your VADoD eBenefits profile. Were here Monday through Friday 800 am.

Service members within 1 180 days from discharge should go to httpswwwvagovdisabilityhow-to-file-claim to submit your Pre-Discharge VA disability claim. Go to your nearest VA regional office and change this information in person. Scroll down to the Track Claims section.

Download a copy of letters like your eligibility or award letter for certain benefits. If you receive VA disability payments you probably were happy to know that for 2021 you get a 13 raise in your benefits but when will you get those monthly checks. Call us at 800-827-1000 TTY.

You can also apply via regular mail by filling out VA Form 21-526EZ Application for Disability Compensation and Related Compensation Benefits. Call VA at 1-800-827-1000 to have the form sent to you. To use this tool youll need to have one of these free accounts.

2 VA check for full disability compensation. We base your monthly payment amount on your disability rating and details about your dependent family members. Check the status of your VA disability and pension payments.

Click on the View Status button for a specific claim. To update your direct deposit information or the address on your paper checks you can. The VA disability retro calculator calculates your back pay by asking several straightforward questions.

If you dont get a payment within 15 days please call the Veterans Help Line at 800-827-1000. Veterans simply type in the answers to get an immediate estimate. Disability payment benefits.

This tool doesnt include ratings for any disability claims that are still in process.

Va Payments For 2020

2020 payments wallpaperBe sure to include your account number on the check or money order. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note.

What Can You Buy With A Va Loan In 2020 Va Loan Loan Home Loans

Department of Veterans Affairs PO Box 3978 Portland OR 97208-3978.

Va payments for 2020. If you receive VA disability payments you probably were happy to know that for 2021 you get a 13 raise in your benefits but when will you get those monthly checks. Looking for the complete list of VA disability rates for 2020. VA Disability Compensation Rate Tables for 2020 VA disability compensation pay is a tax-free benefit paid to veterans with injuries or diseases obtained during or made worse by active duty.

All payments and maximum amounts listed below are applicable to individuals eligible for the full benefit 100 eligibility tier. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. Effective December 1 2020 Example of how to calculate your DIC payment If youre the surviving spouse of a Veteran your monthly rate would start at 135756.

VA payment benefits are are paid the first business day of the following month. Survivors can view past VA payments for certain benefits including Chapter 35 Survivors Pension and Dependency and Indemnity Compensation. Veterans with a rating of 10-20 do not receive any extra compensation for dependents and thus are paid at the single rate which is why those rates werent included on the chart.

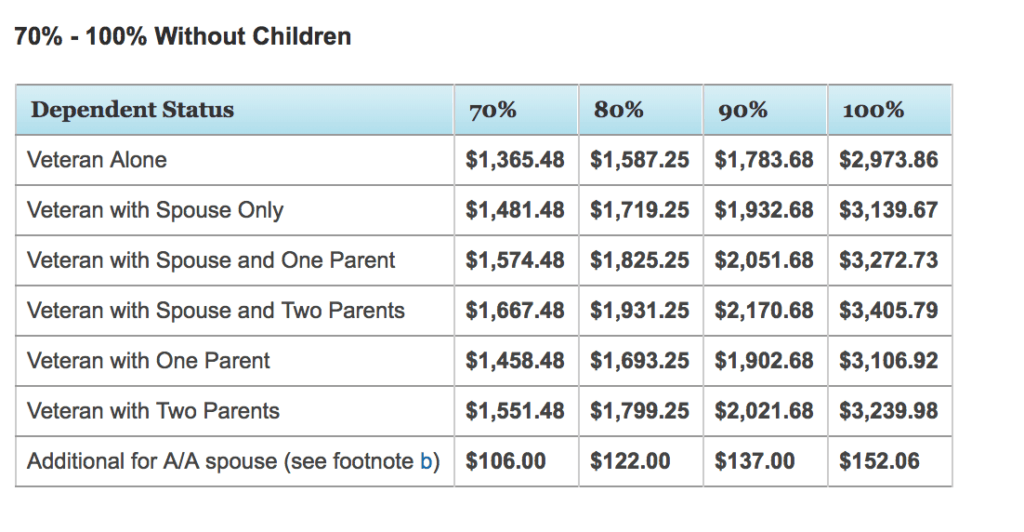

A 10 VA disability rating for 2020 is. A 20 VA disability rating for 2020 is. Compensation rates for Veterans with a 30 to 100 disability rating.

This page provides links to benefit information and services. Compensation rates for Veterans with a 30 to 100 disability rating. Veterans Benefits Administration provides financial and other forms of assistance to veterans and their dependents.

Find the 2021 VA pay schedule for VA disability education compensation pension and survivors benefits that are paid on a monthly basis. Visit your nearest VA medical center and ask for the agent cashiers office. It is important to note that if the first business day of the month falls on a holiday then VA benefits will be paid on the last business day of the preceding month.

The 2020 COLA jump was 16 which means disabled veterans rated at 10 or higher by the VA will receive a 16 increase in their 2020 VA pay rates. These are the latest VA disability compensation rates for 2020. Then for each additional benefit you qualify for you would add the amounts from the Added amounts table.

Post-911 GI Bill Chapter 33 Payment Rates for 2020 Academic Year August 1 2020 - July 31 2021 The Post-911 GI Bill program is comprised of multiple payments. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note. The Department of Veterans Affairs most popular publication the Federal Benefits for Veterans Dependents and Survivors booklet provides brief descriptions of VA programs and benefits including compensation and pension benefits health care memorial and burial benefits facility phone numbers and addresses and more.

View your VA payment history online for disability compensation pension and education benefits. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. Anticipated Payment Schedule for VA Monthly Compensation in 2020 Usually disability benefits for a particular month will be paid on the first business day of the following month.

Send your payment stub along with a check or money order made payable to VA to the address below. Click HERE to view the full 2020 VA disability pay chart.