Civilian Dod Pension

civilian pension wallpaperCivilian Employees Outside the Continental United States OCONUS may access the Toll-Free IVRS System through the numbers below. There are about 796000 DoD civilians in the US but about 221000 of those employees already have exchange benefits resulting from another beneficiary category such as retiree or military.

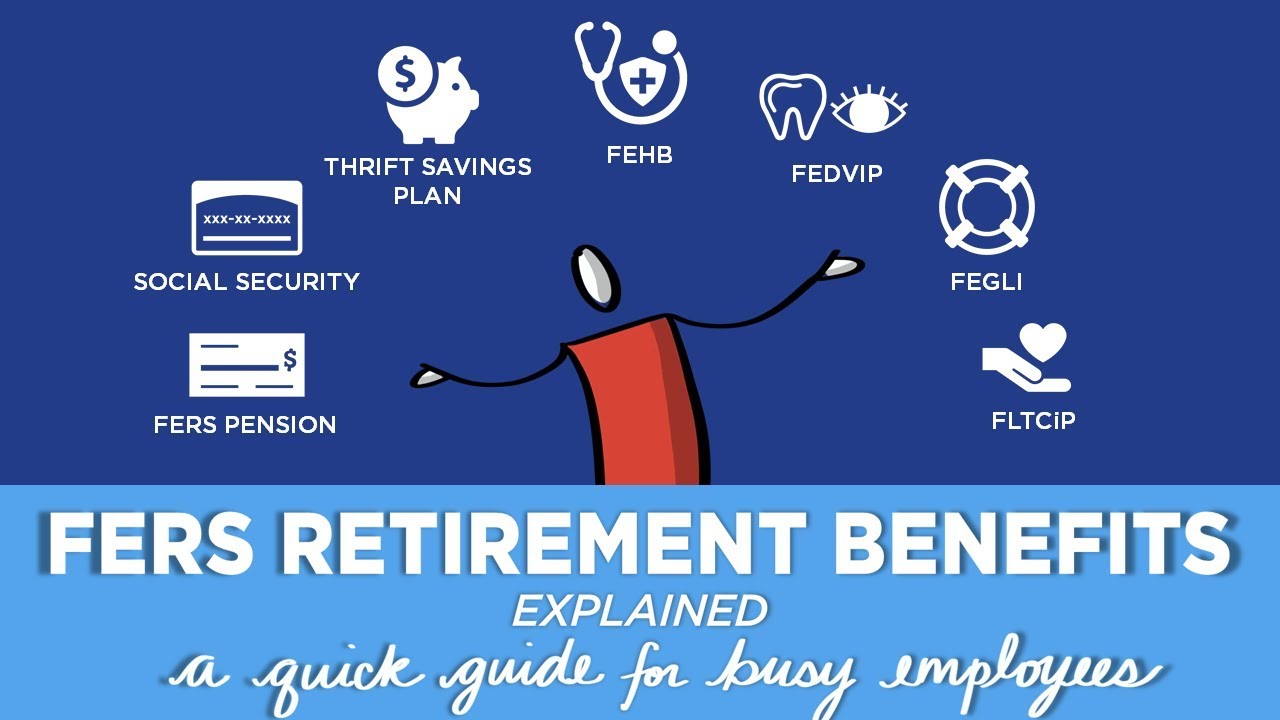

Fers Retirement Benefits Explained A Quick Guide For Busy Employees Youtube

The military pension will be computed according to the provisions of the Tower Amendment.

Civilian dod pension. Estimate your armed forces pension - get a forecast of your armed forces pension apply online or by post. Also known as Tower Pay it is computed by utilizing the current active duty pay. Civilian DOD employees are paid retirement benefits under the Federal Employees Retirement System FERS.

Instruction for Payment of pensionary award in ro Defence Civilan. Armed Forces Pensions Compensation and Veterans. Making a deposit early helps to avoid the accrual of additional interest.

This MOD site contains pension scheme booklets documentation and publications Service Personnel and Veterans Agency - War Pensions Scheme. The federal retirement system is known as FERS the Federal Employees Retirement System. 31082010 to 30082020 or till death or remarriage whichever is earlier.

Civilian 0800-1010282DSN 1986 Italy. And look up your basic allowance for housing on the Defense Travel Management Offices BAH calculator. Civilian pensions are generally guaranteed by the Pension Benefit Guaranty Corporation PBGC.

The final pay method as the name implies establishes the retired pay base equal to final basic pay. Since that time new Federal civilian employees who have retirement coverage are covered by FERS. Most FERS retirees are standard employees.

The high-36 method is the average of the highest 36 months of basic pay divided by 36. You either qualify for retirement by honorably serving for over 20 years or you simply do not. Almost all new employees are automatically covered by the Federal Employees Retirement System FERS.

While this tool only offers unofficial estimates it can help. A world class pension scheme for your military service. Making a deposit for post 1956 military service allows you to receive permanent credit for military service under your Federal civilian retirement system and the military service remains creditable for Social Security purposes.

Thats of course if it applies to the situation. Defined-benefit pension plans are traditional pensions that pay a certain amount each month after you retire. If youre thinking about applying your military time towards your civilian retirement use the new Military Service EarningsBuy-Back Estimator to help you make your decision.

Civilian 800-780821DSN 1986 Japan. Congress set up PBGC to insure the defined-benefit pensions of working Americans. The tool will give you ESTIMATES for both your military earnings and the associated cost to apply that service time towards your federal civilian retirement.

This program extends to all federal employees like postal workers FBI agents and even retired senators and congressmen. Government Retirement Benefits GRB Platform web application. Information on claiming War Disablement Pension War WidowsWidowers Pension from the Private Pensions.

That is why DFAS offers a retirement program that helps provide financial security for you and your family. Military retirement pay isnt really similar to civilian retirement pay. Family Pensiondeath after Retirement Post.

31082020 till death or remarriage whichever is earlier. Of all the retirement plans the Final Pay system uses the simplest formula. A Basic Benefit Plan Social Security and the Thrift Savings Plan TSP.

When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK. He is covered by FERS. Saving for retirement is important for everyone.

3630- per month wef. This is one of the most important benefits you receive as a Federal employee. Service members who entered the armed forces before Sept.

8 1980 and are still serving can use the Final Pay Calculator to estimate their future military pension amount. Military Civilian and Retiree Pay Problems Department of Defense DOD Employees Reservists and Retirees. Most federal civilian employees hired after 1983 are automatically covered by FERS which is described as a three-tiered retirement plan including the following.

He has been employed as a civilian employee with the Defense Department since his military retirement and will have 23 years of civilian service by the time he retires in 2008. Youll receive 25 of your final monthly basic pay for every year of service. Rs6050- per month payable to Widow wef.

Civilian 0800-78245DSN 1986 Germany. 1-877-276-9287 dial 809-463. Various types of Pensionary Awards.

FERS is a retirement plan that provides benefits from three different sources.