Does The Gi Bill Cover Child Care

child does wallpaperDepending on where you live and which. The bulk of the funding will go toward the Child Care Development Block Grant CCDBG to fund grants for child-care providers which they can use to stabilize their businesses in a number of.

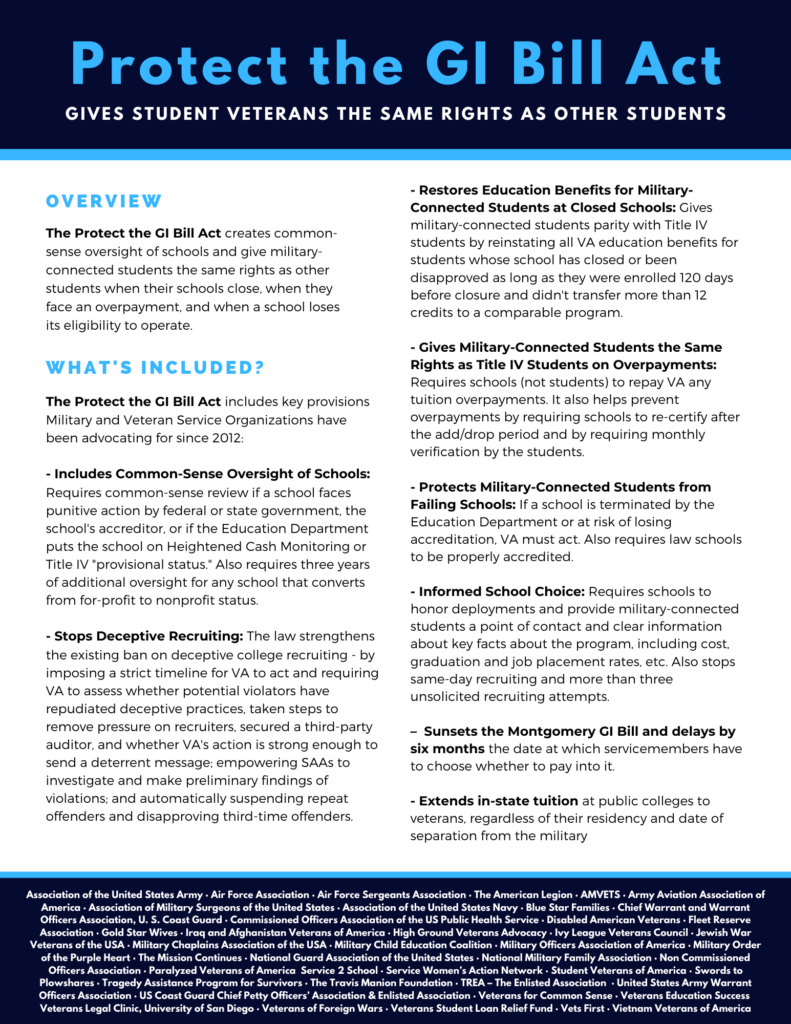

Learn About The Protect The Gi Bill Act Veterans Education Success

The funds that are disbursed via the GI.

Does the gi bill cover child care. Learn more about GI Bill benefits belowand how to apply for them. Just a way out of debt. To use the GI Bill the dependent must be 18 or a.

Transfer the benefit and rest easy knowing your childs college expenses are taken care of. You can only get Tax-Free Childcare to help pay for childcare provided by a relative for example a grandparent if theyre a registered childminder and care for your child outside your home. If Im the child of a veteran am i eligible for benefits.

The reason its paid for right now is because of TA but that only pays for the cost of the class and books Im wanting to know if I can collect on my GI bill to make up for the fact my wife will have to work less we cant afford the childcare that would be involved if we cant collect on the bill. There are certain limitations and new rules passed. If neither you or your spouse need the GI Bill and you only have one child your job is done.

But many people face a more complicated situation. If youre a qualified service member you can transfer all 36 months or a portion of your Post-911 GI Bill benefits to a spouse or child. Your Debt Consolidation Alternative.

Bill are earmarked funds specifically set out for use in obtaining post-secondary school education and as such are most typically unavailable for attachment by your spouse in regards to any amount of child support owed. 11 2001 to receive 100 percent of the benefits offered under the Post-911 GI Bill which includes coverage of. Such plans generally allow a 500 carryover for unused funds at.

The Coronavirus Aid Relief and Economic Security CARES Act is a 22 trillion economic stimulus bill that passed with near unanimous bipartisan support in the House and Senate and was signed into law on March 27 2020. Those discharged prior to Jan. The new GI Bill allows anyone who has received a Purple Heart on or after Sept.

A dependent child must be 18 or younger when the GI Bill benefits are transferred to them or under 23 in special cases for approved programs. Fact 2 - The GI Bill Is Not Federal Financial Aid. To keep getting your 30 hours free childcare or Tax-Free Childcare you must sign in every 3 months and.

The Post-911 GI Bill can pay your full tuition fees at school provide you with a monthly housing allowance while you are going to school and give you up to 1000 a year to use for books and. Use Your GI Bill Benefits To Help Pay For College Why You Should Love The New GI Bill Your Updated Guide To MILITARY CHILD CARE What To Do When You Receive Your PCS Orders. Consolidate credit bills into one easy monthly payment.

Pay off your debt faster. The Department of Defense approves a transfer of benefits. Learn about transferring Post-911 GI Bill benefits.

Its not a loan. If he or she came into the military in 1984 or later it was the Montgomery GI Bill. Use this account to get your 30 hours free childcare or pay for your Tax-Free Childcare.

Then no you dont have any educational benefits you can use. Lower your interest rates. 1 2013 and using the Post-911 GI Bill have 15 years from their discharge to use all their GI Bill.

There are 2 main GI Bill programs offering educational assistance to survivors and dependents of Veterans. Since 1944 the GI Bill has helped qualifying Veterans and their family members get money to cover all or some of the costs for school or training. It really depends on which GI bill your parent qualified for.

Start Online or call 800 565-8953. Although the earnings will not be tax-free they will be tax-deferred and you may be able to shift the income to your daughters lower income-tax bracket during the withdrawal years. Get more information about the Fry Scholarship.

If you expect the total of your Post-911 GI Bill payments to be more than the balance in your 529 plan you can consider making additional contributions to your 529 plan. There is good news for those of you out there who are eligible for the Post-911 GI Bill you may be eligible to transfer your GI Bill to a spouse or child if you meet the minimum service requirements and agree to extend your military service obligation. The Marine Gunnery Sergeant John David Fry Scholarship Fry Scholarship is for children and spouses of service members who died in the line of duty after September 10 2001.

The bill which Congress passed on Monday removes the limit for what people with dependent care FSAs can roll over in 2021 and 2022.