Which States Have No Property Tax For Disabled Veterans

disabled statesThere are currently no state-mandated property tax exemptions for disabled veterans in Delaware. In Kansas theres no property tax exemption per se but there is a refund -- at least for disabled veterans.

Https Www Colorado Gov Pacific Sites Default Files Instructions 20for 20disabled 20veterans 20exemption Pdf

Here are the five best cities for disabled vets offering varied advantages such as VA health facility access quality of life and state tax benefits.

Which states have no property tax for disabled veterans. Indiana disabled veterans may qualify for an up to 12480 reduction in property taxation if the assessed value of the property does not exceed state guidelines. Many other states have state income tax but. Removing Property Taxes From Escrow Account.

Veterans with at least a 50 disability can apply for a partial refund of their. Indianas property tax exemption takes things one step further with both a disability requirement and an age requirement. If youre under 62 you must have a 100 service-related disability rating and served honorably during any period of wartime to get a 24960 deduction form the assessed value of the property.

13 States with No Property Tax for SeniorsPeople Over 65. Only California Montana New Mexico North Dakota Rhode Island Utah Vermont and Virginia require veterans to pay taxes on their retirement income. A disabled veteran in Florida may receive a property tax exemption of 5000 on any property heshe owns if 10 percent or more disabled and a full exemption if 100 percent disabled as a result of service.

In addition VA tax benefits can vary from state to state. In addition to no state income tax retired homeowners may also. Tax-wise South Dakota is one of the best states for retirees.

States offer some property tax discount or exemption for disabled military veterans. Disabled veterans have unique home buying needs that are different for each individual. Its freedom from paying a property tax.

Arkansas exempts the homestead of certain disabled veterans from property taxes. Many states offer exemptions solely for disabled veterans. Minnesota Property Tax Exemptions In the State of Minnesota veterans rated as 100 totally and permanently disabled may be eligible for a property tax valuation exclusion up to 300000.

Meanwhile a 100 service-related disabled veteran may get a full property tax exemption. The only property tax exemption in the state is for homeowners 65 and. Delaware is one of the few states that has no property tax exemptions for either disabled homeowners or disabled veterans.

A property tax exemption is what it sounds like. There are currently no state-mandated property tax exemptions for disabled veterans in Delaware. Additionally there are also property tax discounts and reductions.

Those with disability ratings at 70 or higher may be eligible for the same consideration at a maximum of 150000. Florida A disabled veteran in Florida may receive a property tax exemption of 5000 on any property heshe owns if 10 percent or more disabled and a full exemption if 100 percent disabled as a result of service. First an application for a.

Disabled Texas veterans are eligible for a property tax exemption of up to 12000 on the value of one property.

Pin On Ok Dav Oklahoma Disabled American Veterans

How To Find Small Business Grants For Veterans Grants For Veterans Business Grants Business Loans

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Military Benefits

All Veteran Property Tax Exemptions By State And Disability Rating Property Tax Tax Exemption Disability

Property Tax Breaks For Disabled Veterans

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage

Veteran Owned Tax Businesses Tax Forms Income Tax Irs Tax Forms

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

All Veteran Property Tax Exemptions By State And Disability Rating Tax Exemption Property Tax Tax

10 Us Cities With Highest Property Taxes Infographic Property Tax Family Income

Exemptions Reduce Disabled Veterans Taxes Brazoria County Appraisal District

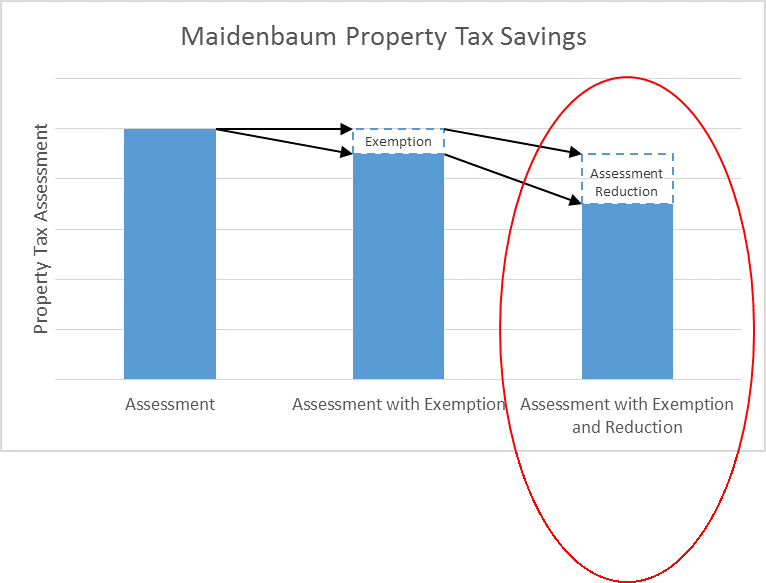

All The Nassau County Property Tax Exemptions You Should Know About

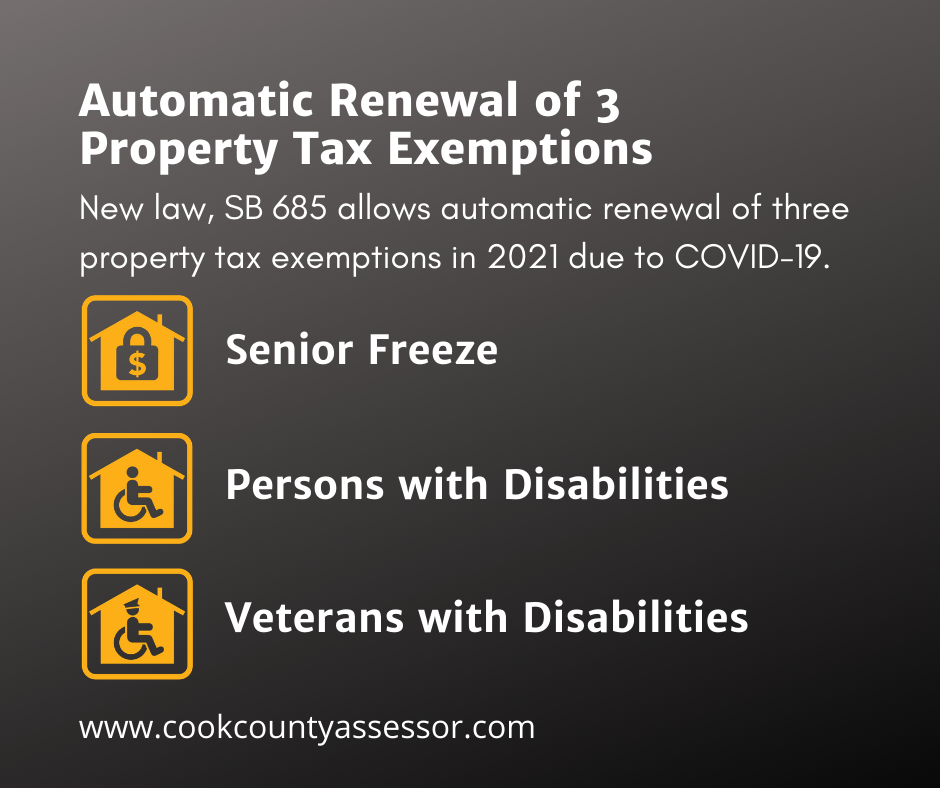

Automatic Renewal Of 3 Property Tax Exemptions In 2021 Due To Covid 19 Cook County Assessor S Office

Veterans Who Have A Va Compensation Rating Of 100 P T May Or May Not Qualify For Social Security Disabil Va Disability Social Security Disability Disability