How Much Is The Irish Old Age Pension

irish muchSuccessful single claimants over the age of seventy were paid five shillings a week while couples in which the husband was aged over seventy got seven shillings and sixpence per week. Your rate of payment will depend on the outcome of the means test.

Irish Public Pension System Expenditure Trends And Recipient Numbers Public Policy

Could you survive on the State pension alone and what will your finances look like in retirement.

How much is the irish old age pension. If you are aged 80 and over the rate is 247. You are automatically paid an extra allowance of 10 per week when you reach 80 years of age. The State pension is intended to ensure that everyone receives a basic standard of living in retirement.

The means-tested State Pension Non-Contributory is a payment for people aged over 66 who do not qualify for a State Pension Contributory or who only qualify for a reduced contributory pension based on their insurance record. Given here is an online Irish State pension calculator using which one could estimate the pension that heshe would. The current State Pension is 12912 per year or 24830 per week as of March 2019.

How can I claim my Irish State pension from abroad. This pension is taxable but you are unlikely to pay tax if it is your only income. What is the State pension.

From March 2019 the State pension in Ireland for a person aged 66 or over is 24830 per week. The Living Alone Increase may be payable to people who live completely alone. Any increases in your State Pension Contributory for a qualified adult dependant and pensioners over 80 years of age are calculated in the same way as the personal rate of pension.

Qualifying age for State pensions. I worked in Ireland in the 1980s but now I live in US state of Florida Sun Mar 5 2017 1201 Updated. The State pension increases by 10 per week for those over age 80.

You may also be eligible for other benefits. The State pension contributory is paid to people from the age of 66 who have enough Irish social insurance contributions. The minimum age you can qualify for a State Pension Contributory will be 66 It had been proposed to increase the age at which you receive State pension contributory to age 67 in 2021 and 68 in 2028.

If you are aged 66 and under 80 the rate is 237. The below shows the maximum personal weekly rate of payment a person can receive if they have no income from any source. Sun Mar 5 2017 1401.

The Old Age Contributory Pension is payable to people in Ireland from the age of 66 who have. This pension is taxable but you are unlikely to pay tax if it is your only income. For example the full State Pension Contributory is 12912 per year or 24830 per week.

The Irish State Pension is a contribution that is paid to people from their savings from Irish social insurance contributions from the age of 66. While not worth as much as the full State pension 24330 you might still be entitled to the top rate of 198. This increase is not paid to qualified adults.

Increases for a qualified child are payable from one country only and if from Ireland are paid in full. Some people do not receive a full State pension because they have not been credited with enough PRSI contribution payments. This calculator includes the State Pension as part of the Target Pension payable from the state retirement age.

It is not means-tested and you can have other incomes and still get the State pension.

Ageing Europe Statistics On Pensions Income And Expenditure Statistics Explained

Paul Henry Old Age Pensioners 1911 Irish Art Irish Painters Art

Labour S Pension Plan Old Age Widows And Children Published By National Council Of Labour 1937 Old Age How To Plan Pensions

Help I Ve No Prsi Stamps Can I Still Get A Pension

Irishmen Stand Outside Of Soldier Barracks In Early Dublin Ancient Ireland Irish History Photo

Dublin Fire Brigade Logbook Easter 1916 Language Forms Irish History Fire Brigade

Retirement Ages Finnish Centre For Pensions

Make Your Claim Now For Conservative Old Age Pensions Beginning January 1928 Published By The National Union Of Conservative And Union Pensions Old Age Age

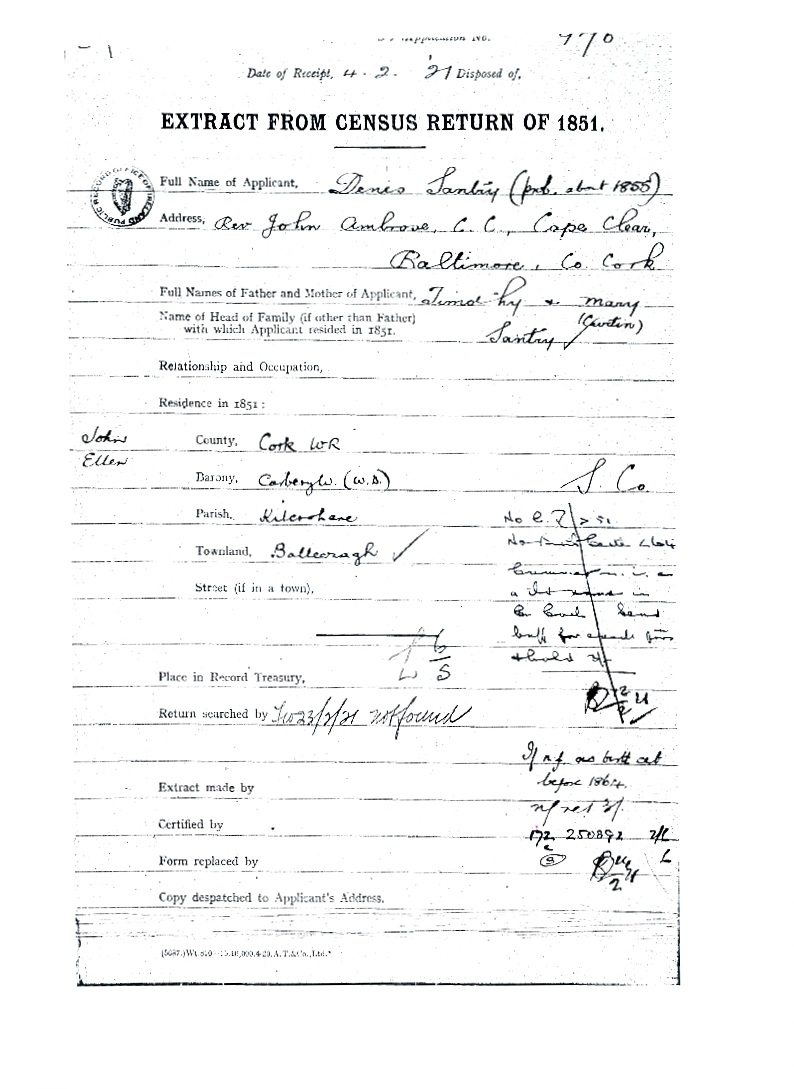

Irish Pension Records And Their Value For Family History Research

Rare Vintage 1930 S Coin Operated Old Age Pension Trade Stimulator Dice Game

Barbados Non Contributory Old Age Pension

Old Age Pension Adhra Pradesh Pensions Old Age Age

Ranked The Best And Worst Pension Plans By Country Infographic Population Country Approach Cashing Pension Plan Pensions How To Plan

British Troops Gathered In Trinity College During The Rising Courtesy Mercier Press Archive Ireland History Irish History Irish Independence

How Can I Claim My Irish State Pension From Abroad