Do Military Spouses Pay State Taxes In Colorado

colorado military spousesHowever if any nonmilitary Colorado sourced income was earned this income must be reported to Colorado for income tax purposes. If you are a military spouse you may have been told that you do not have to pay North Carolina income taxes due to The Military Spouses Residency Relief Act of 2009.

You will also need to provide a copy of your military dependent ID card.

Do military spouses pay state taxes in colorado. Up to 6250 plus 50 of retired pay over that amount is tax-free for 2019. Military spouses no longer have to file multiple part-year and nonresident income tax returns when they earn wages. If a retired servicemember is under 55 years of age at the end of the tax year they may claim the military retirement subtraction on line 5 or 6 of the Subtractions from Income Schedule for military retirement benefits included in their federal taxable income subject to the following limitations based on the tax yearMilitary Retirement Subtraction Limits.

This is not entirely true. Many members of the military have found the allure of Colorado Florida or Texas too much to pass up and plan to come back to the state in retirement for example. Your home of record or state of legal residence is where you would pay your state taxes if your state requires you to pay state tax.

No matter how you file Block has your back. Then use the 104PN to compute the Colorado tax liability. Enter in the Colorado column the full year income of the resident spouse plus the income reportable to Colorado if any by the part-year or nonresident spouse.

Voting A military spouse may vote within their spouses legal state of residence. Nonmilitary spouses can use their military spouses resident state when filing their taxes. For more information see Filing State Income Taxes When Youre in the Military.

Both spouses are subject to tax income and property in their home states. When youre constantly on the move it can be hard to know where to file your state income taxes. Compute a tentative tax as if both individuals were full-year residents.

In the past a spouse may have had to file a different state tax return because they had split legal residences. The spouse moved to Colorado from another state and the spouse works in Colorado. If a servicemember is not a Colorado resident and is instead a resident of another state his or her spouse can elect to also be a resident of that state and not a resident of Colorado.

There are rules for military service members and slightly different rules for military spouses. Thankfully active-duty service members and their spouses have protections under the Servicemembers Civil Relief Act SCRA including one regarding where to claim residency for the purposes of taxes and voting. And the.

Several special rules apply in determining the Colorado income tax liability of an active duty or retired military servicemember. So if you meet the requirements of the Military Spouses Residency Relief Act both your income and the military income earned by your spouse in the military are free from taxation in the duty station state. Under the Military Spouses Residency Relief Act signed into law on November 11 2009 military spouses who earn income in the state where their spouse is stationed may be able to claim either the.

If a servicemembers spouse is required to file a Colorado income tax return a copy of this affidavit along with a copy of his or her dependent ID card must be submitted with his or her Colorado income tax return. To claim tax-exempt from Colorado withholdings. Whether and how a servicemembers income is taxed depends largely on the service-members state of legal residence.

Up to 5000 of military income is tax-free Retired pay. The spouse is not a resident of Colorado. This allows military spouses to elect to use their service members state of legal residence for state and local taxes he said.

Additionally if a servicemember and. This form needs to be completed each year. Use the 104PN to compute the ratio of the joint.

Active Duty Military pay is included in the Colorado Adjusted Gross Income when tax is figured. To claim a refund of taxes withheld from your Colorado income follow these steps in the program. If you are a nonresident stationed in Colorado you are not taxed on the military income earned in Colorado.

Additionally military retirement benefits may be fully or partially exempted from Colorado taxation. If you wish to claim tax-exempt withholding due to the Military Spouse Residency Relief Act MSRRA you will need to complete Form DR-1059 and submit it to your employer. That will increase to 75 in 2021 and 100 for.

The Military Spouse Residency Relief Act MSRRA describes where spouses of military service members can file state income taxes. According to the North Carolina Department of Revenue NCDOR tax-exempt status for a military spouse can only be acquired if the spouses domicile is the same state as that of the service member. The Military Spouse Residency Relief Act MSRRA allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse regardless of which.

The spouse must meet all of the following criteria. For tax years beginning on or after January 1 2009 a military spouse may be able to exclude their wages and tips from Colorado income tax in certain circumstances. The service person and their spouse are married.

Colorado Income Tax and Wage Withholding Tax Exemption Federal law 50 USC. 4001c precludes Colorado from taxing the income earned by the spouse of a servicemember for services performed within Colorado if both. Even if you are stationed in another state youre still considered a resident of your SLR.

A servicemembers spouse may elect for income tax purposes to use the same state of residence as the servicemember. Form DD 2058 State of Legal Residence Certificate may need to be filled out according to state requirements.

Https Www Colorado Gov Pacific Sites Default Files 2019 12 Income21 Pdf

Military Spouse Act Residency Relief Msrra Military Benefits

Military Spouses And Drivers Licenses Katehorrell

Five Questions About Military Spouse State Taxes Military Com

Top 6 Ghost Tours Near Military Installations Ghost Tour Military Spouse Support Military Kids

Https Www Dcms Uscg Mil Portals 10 Cg 1 Ppc Guides Gp Spo Deductions State Tax Withholding Exceptions Pdf

State Of Legal Residence Vs Home Of Record Military Com

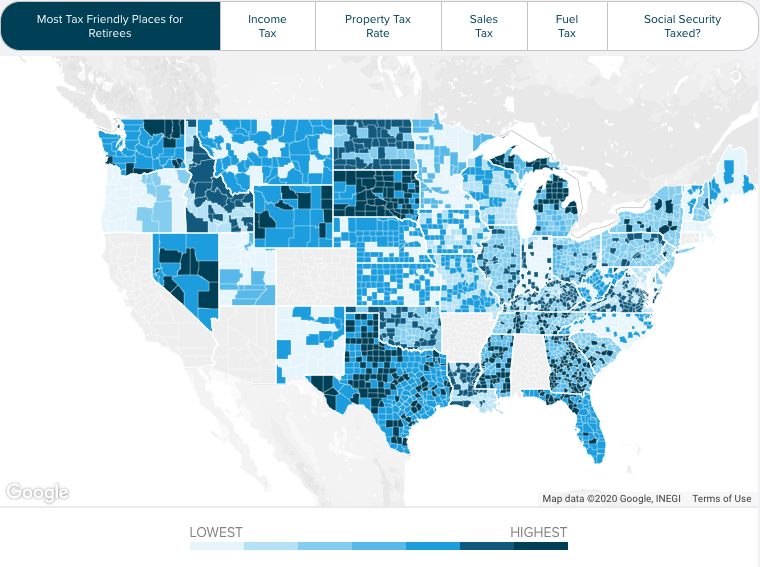

All Veteran Property Tax Exemptions By State And Disability Rating Military Benefits Veteran Property Tax

Best Tax Tips For Military Spouses In 2020 Military Spouse

Which States Tax Social Security Retirement Benefits Retirement Benefits State Tax Social Security

Colorado Retirement Tax Friendliness Smartasset

How To Pay Less Taxes Advice From The Irs Tax Debt Tax Write Offs Filing Taxes

Military Taxes How To Pay Your Taxes While Deployed

New Law Will Make Tax Time Easier For Military Spouses Katehorrell

Tax Tips For Two State Residents Military Com

Knowing What All Is Included On The Leave And Earnings Statement Is An Important Part Of Building A Family Bud Family Budget Veterans United Statement Template

Understanding State Tax Laws For Telecommuting Military Spouses Military Spouse State Tax Military Spouse Career