Va Loan Social Security Income

loan security social wallpaperThe VA wants to ensure that borrowers are consistently able to pay their mortgages so income must meet three standards. For example a family of four in the Midwest would typically need 1003 in residual income.

Louisville Kentucky Va Home Loan Mortgage Lender Kentucky Va Mortgage Refinance Va Mortgages Refinance Mortgage Loan

Overtime or Bonus Income.

Va loan social security income. For retirees lenders will want to know they can afford to live in the home they purchase. Social Security can also be included in income. Anticipated to continue during the forseeable future and.

Is a satisfactory credit risk and has present and anticipated income that bears a proper relation to the contemplated terms of repayment. Loans IRRRL except IRRRLs to refinance delinquent VA loans. Qualifying for a VA Loan Using Retirement Income Veterans and service members can look to qualify for a VA home loan using retirement income which is great news for many homebuyers.

At Veterans United we can gross up non-taxable income by 25 percent. Check your VA loan eligibility. VA Loans are a Judgment Call.

Now VA loan programs allow grossing up 25. Conforming loans allow this tax-exempt income to be grossed up 25. For example lets say the only income you receive is non-taxable.

Most often private lenders attempting to verify incomeearnings will request documentation of your reported taxable income for the last couple years often in the form of your W2s. In order to count toward a VA loan application income must be. USDA loans allow nontaxable income to be grossed up 25.

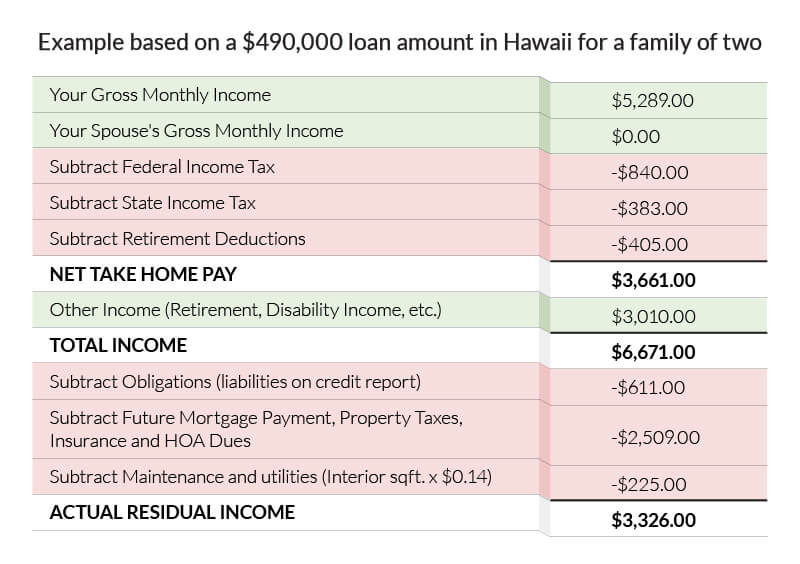

At Veterans United all borrowers with a DTI ratio above 41 percent must have enough residual income to exceed their guideline by 20 percent. Military Income as shown on your LES. If the borrowers gross monthly income is 5000 then the ratio in this example is 2028 divided by 5000 41 or the maximum VA debt ratio limit.

Savings are an excellent start but income goes a long way in qualifying. Countable income is your total income earned and unearned minus allowable deductions. If you receive Social Security retirement benefits or Social Security Disability benefits the Department of Veterans Affairs considers your benefits to be part of your countable income when determining your eligibility to receive VA Pension benefits.

As mentioned not all loan programs use the same percentage to gross up income. While VA-backed loans often enjoy freedom from down payment requirements and more leniency on credit scores they do still require documentationverification of income. Salary W-2 Income.

The Department of Veterans Affairs VA allows lenders to use Social Security disability income as qualifying income for VA-guaranteed mortgages and emphasizes that its not necessary to obtain a statement from the consumers physician about how long a medical condition will last. 5 A designated officer of the lender authorized to execute documents. Types of Acceptable Income.

Recently VA clarified their stance on gross up income. If your monthly non-taxable income is 2000 and your major monthly debts are 900 thats a 45 percent DTI ratio 9002000. VAs underwriting standards are incorporated into VA regulations at 38 CFR 364337 and explained in this chapter.

Anything at or below that 41 number is an. FHA loans allow nontaxable income to be grossed up 15. You will need to be able to verify this income in order to qualify for the home loan.

However your VA benefits are reduced by your Social Security payments. 4 Indicate the loan decision in Item 51 of the VA Form 26-6393 Loan Analysis after ensuring that the treatment of income debts and credit is compliant with VA underwriting standards. The lender will use an average of the last 2 years of bonus or overtime income received.

Down Payment Assistance Programs. By law VA may only guarantee a loan when it is possible to determine that the veteran. Both may be used to qualify if the income has been received for the past two years and is likely to continue.

According to the VA Loan Handbook these types of income can usually be counted toward qualification income. Non-service VA benefits are income-based which means any other income such as Social Security reduces your benefit amounts.

Va Loan Q A What Is An Assumable Mortgage Zing Blog By Quicken Loans

Va Home Loan Assumption What Buyers Need To Know

Va Residual Income Why It S Important And How It S Calculated Hawaii Va Loans Va Home Buying Made Easy

Pros And Cons Of The Va Loan Mortgage Tips Va Loan Real Estate Articles

Va Loan Limit Rules Military Benefits

3 Ways Your Child Could Directly Impact Your Va Loan Home Loans Va Loan Child Support Quotes

Example Of A 450 000 Home Purchase Using Va Financing In California

Kentucky Va Mortgage Lender Guidelines Kentucky Va Mortgage Lender Va Mortgages Va Mortgage Loans Mortgage Lenders

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Kentucky Usda Rural Housing Loans How Long Does It Take To Close A Usda Loan In Kentucky Usda Loan Usda Mortgage Lenders

Va Loans All Your Questions Answered The Truth About Mortgage

Khc Loan Programs Mortgage Loans Kentucky Underwriting

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

How Does Your Dd 214 Help You Get A Va Home Loan

Pin On Mortgage Processing Tips

How To Process A Va Loan In 2020 Department Of Veterans Affairs Loan Va Loan

The Va Home Loan Program Provides Qualified Homeowners With A Simple Way To Take Advantage Of Lower Rates And Decrea Refinance Loans Refinance Mortgage Va Loan